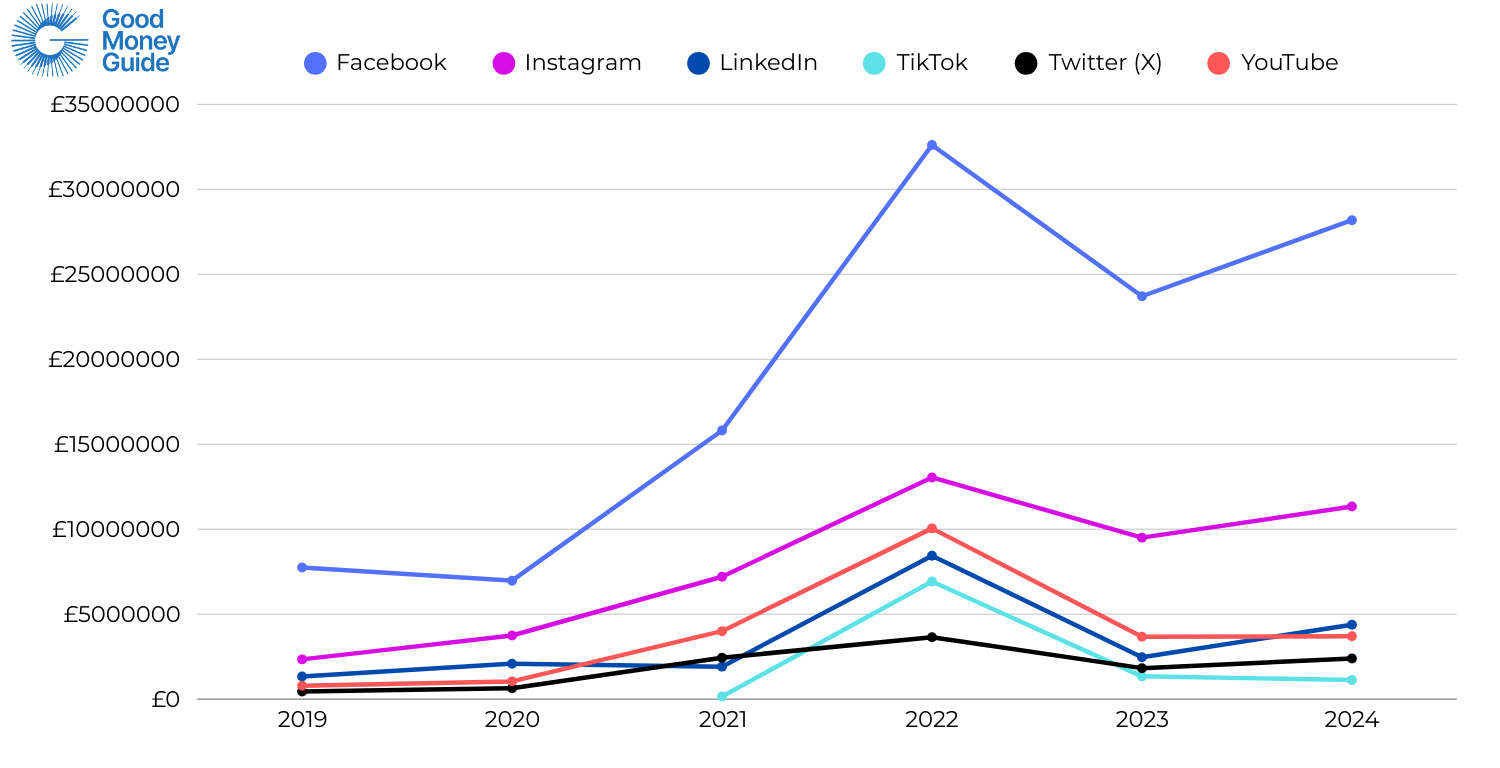

Data from the police reveals that British social media users have incurred losses of £214 million due to financial scams over the past half-decade.

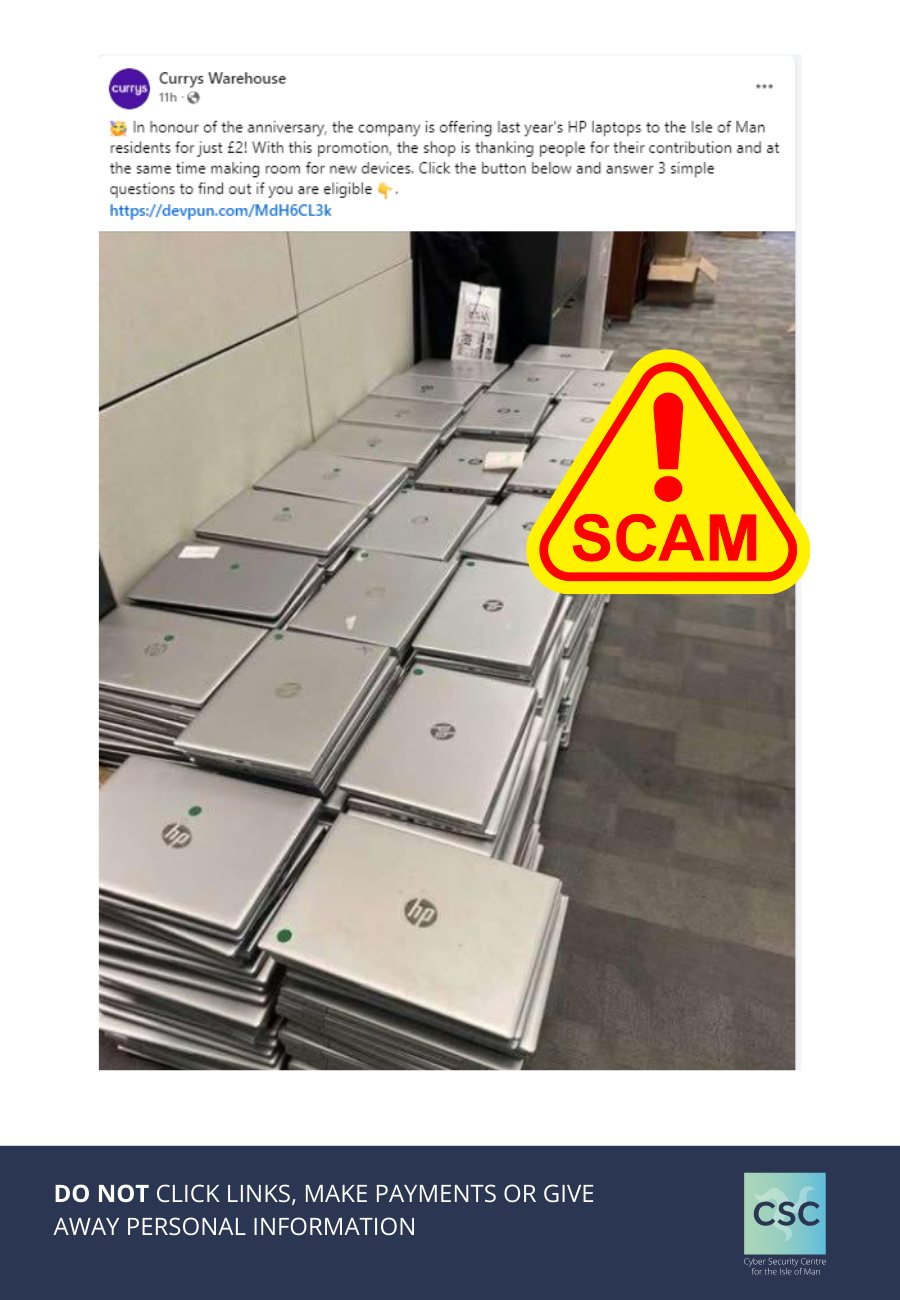

Facebook has overtaken Instagram As the least desirable location for scams, where the first area recorded 1,411 complaints to law enforcement in 2024 and the second had 828 reports.

losses through the social network amounted to £28 million in 2024, followed by the picture-sharing platform, which reported losses of £11 million, as per the data provided. Action Fraud, the nationwide platform for reporting fraud and cybercrimes.

LinkedIn experienced the lowest number of reported cases when compared to rival platforms, despite having the most substantial financial losses per scam for its users.

Each report revealed that over £40,000 was lost from businesses using the networking platform, according to data acquired by the comparison site Good Money Guide. Scams were growing fastest on TikTok, With reports rising by 63% in 2024 compared to the previous year — even though the average loss declined by 58%.

Richard Berry, the founder of the Good Money Guide , stated: 'The issue of financial frauds on social media isn’t disappearing – and it’s high time that these platforms were made accountable.'

'In just the past five years, UK consumers have lost over £214 million to scams, yet these platforms aren’t treating this issue with sufficient seriousness.'

'It took nearly three years for Facebook to take down an ad I reported as fake, which is disheartening when considering all the people who may have fallen victim during this period.'

'It's high time that regulators began penalizing social networks for prioritizing profits over protection, which permits such fraudulent advertisements to appear.'

If you're planning to invest, ensure you work with a reputable firm that is regulated by the FCA and conduct thorough research beforehand. Investing doesn’t require rushing into decisions; if you experience any pressure or encounter offers that seem overly attractive, they might not be genuine.

In January, Sport.bangjo.co.id covered a former soldier who had his life savings stolen by a fraudster who utilized Sir Rod Stewart’s likeness to promote a fraudulent investment scheme.

Wayne Westhead, aged 65, previously served as an British Army The major put £200,000 into the scam. Bitcoin plan while his spouse was fighting against breast cancer.

In order to take care of her, he left his position and started looking for methods to increase his Army pension so they could both be supported.

He subsequently came across an advertisement on Facebook promoting a Bitcoin investment plan that guaranteed substantial profits with minimal risk, seemingly backed by the celebrity.

Increasing number of social media frauds

Since the beginning of this decade, financial scams on social media have surged dramatically, with reported crimes tripling over a span of just three years.

The total reported losses were six times greater compared to what they were three years earlier, increasing from £13 million in 2019 to £75 million in 2022.

An investor informed the police that in 2022, they lost £4 million due to a fraudulent scheme on social media, representing nearly six times the largest individual loss documented in 2021, which stood at £700,000.

Out of the victims, 24 were young children below the age of 10, while 593 victims were under the age of 20.

The data was obtained by the Good Money Guide through a Freedom of Information Act request directed at the National Fraud Intelligence Bureau, an entity affiliated with Action Fraud under the jurisdiction of the City of London Police. This information pertains to reports associated with social media platforms mentioning terms such as 'trading,' 'investing,' 'stocks,' 'crypto,' or 'broker' during the past half-decade.

Sir Rod was unaware that his image was being utilized for the scam and did not take part in it at all.

The statistics align with an increase in social media and email account hacking incidents, as revealed by distinct data indicating that 34,434 cases were reported to Action Fraud in 2024, up from 22,530 the previous year.

The country’s reporting agency has teamed up with Meta to promote an additional layer of internet safety for users by activating two-factor authentication across all their online accounts.

The primary reasons behind social media hacking typically included investment scams, ticket fraud, or stealing accounts.

A representative from LinkedIn informed Sport.bangjo.co.id 'We're putting our resources into advanced technologies such as artificial intelligence, along with groups of specialists, to identify and eliminate most of the recognized scams and counterfeit profiles before they reach our members.'

'We provide complimentary identity verification to assist our members in making more knowledgeable choices about whom they interact with. Additionally, we have an optional security feature that, once activated, might automatically identify potentially dangerous content such as frauds. We also urge our members to inform us of any dubious messages so we can look into them.'

The company behind Facebook and Instagram, Meta, asserts that it does not tolerate fraudulent activities and collaborates closely with law enforcement agencies to remove scammers from its platforms.

The prominent social media company has lately extended the trial of its facial recognition tech to the UK and EU with the aim of safeguarding individuals from various threats. ‘celeb-bait’ scams to facilitate quicker account restoration.

It is collaborating with the industry-driven organization Stop Scams UK, which is a business association, to detect scams at their origin.

Meta urges social media users to develop robust passwords, activate two-step verification, and remain wary of communications requesting private information.

Among the platforms for which data was supplied, Facebook had the highest number of users, boasting over three billion active users worldwide as of early 2024, according to statistics from Data Service Statista.

TikTok has established community guidelines designed to help users understand how to manage their finances responsibly, ensuring they can do so safely without fear of falling victim to scams or experiencing financial abuse.

The video-sharing platform asserts that it does not permit efforts to deceive or swindle individuals within its community.

In the final quarter of 2024, out of all the videos removed due to violations of fraud and scam policies, 95.3% were detected and eliminated preemptively—before anyone filed a report.

The platform, owned by a Chinese company, has agreed to join the UK government’s Online Fraud Charter and promised to implement further measures to prevent and eliminate deceptive material from its site.

This involves becoming one of the initial platforms to commit to allowing users to locate where they can report fraud and scams 'with just two clicks,' which was praised by the government in its Fraud Strategy.

For reporting fraud and obtaining guidance or details, please visit Action Fraud

Would you like to share a story? Get in touch with us. josh.layton@Sport.bangjo.co.id.co.uk

Get the latest on all the discussions everyone's having by subscribing to Sport.bangjo.co.id's News Updates newsletter.

Our website uses cookies to improve your experience. Learn more