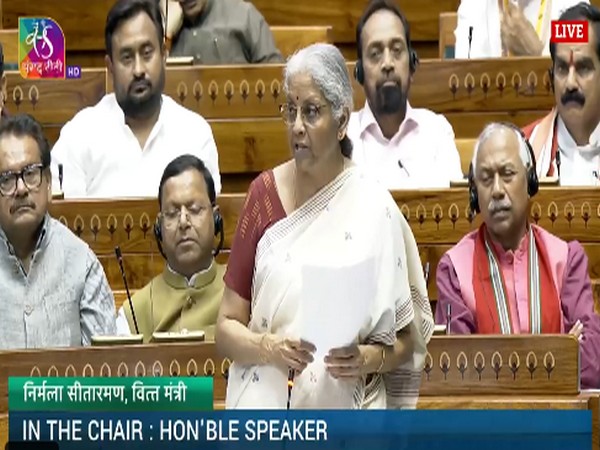

New Delhi [India], March 25 (ANI): Union Finance and Corporate Affairs Minister Nirmala Sitharaman On Tuesday, they stated that the new one Income Tax Bill will be addressed during the discussion. monsoon session of Parliament.

The Finance Minister, Sitharaman, discussed the Finance Bill at length in Parliament today, noting that the Finance Bill 2025 offers extraordinary tax benefits to recognize contributors.

This new Income Tax Introduced in Lok Sabha by Union Finance Minister Bill Nirmala Sitharaman On February 13, aims to substitute the current system Income Tax The Act from 1961 should be amended to include modifications impacting various taxpayer groups such as individual citizens, enterprises, and nonprofit organizations.

In the July 2024 budget, the government announced a thorough examination of the Income-tax Act from 1961. This initiative aimed to streamline the act for clarity and brevity while also aiming to decrease conflicts and legal battles.

On March 18, the government urged the stakeholders to submit their recommendations regarding the recently introduced measures. Income Tax Bill2025. The legislation is presently being reviewed by the Select Committee for thorough scrutiny.

In response to queries about the Finance Bill 2025 today, Financial Minister Sitharaman emphasized the Union government’s dedication to ensuring tax stability and simplifying business norms. This effort aligns with the overarching objective of developing a Viksit Bharat by 2047.

The budget seeks to implement reforms with the goal of achieving Vikshit Bharat by 2047. It intends to offer tax stability, undertake Ease of Doing Business improvements, and introduce a new measure. Income Tax The bill is presently under consideration by a specific committee. It has not been introduced as part of the Finance Bill, according to Sitharaman.

Expanding on the tax changes, she revealed a decrease in custom duty rates for industrial products, reducing the number of tariff brackets from 21 to only eight. Furthermore, she explained that under direct taxation rules, either a cess or a surcharge can be imposed on an item, but not both simultaneously.

"Seven customized tariff rates for industrial products have been eliminated, lowering the duty from 21 to 8 percent. We've made sure that no product includes a Cess charge, and only a single surcharge may be imposed. Additionally, this surcharge can apply to just one category at most," states FM Sitharaman during her discussion on direct taxation matters.

In response to worries about indirect taxes, the finance minister confirmed that offerings like prasadams from temples, mosques, churches, and gurudwaras will stay exempt from GST.

She also noted that a Group of Ministers (GoM) is currently assessing potential reductions in GST rates on ingredients used in making these prasadams. Additionally, she stated that imported medications for rare conditions—regardless of whether they are brought in by individuals or research entities—are now exempt from Integrated GST (IGST).

She additionally emphasized the suggestion concerning Customs, with the intention of streamlining the tariff system and tackling duty inversion issues.

She further stated that these measures would also aid in manufacturing and enhancing domestic value addition, boost exports, streamline trade processes, and offer assistance to ordinary citizens.

She went on to say, "For the Budget 2025, our objective is to increase local manufacturing and improve export competitiveness through lower tariffs on raw materials and components, thereby making domestically produced goods more economical." (ANI)

Our website uses cookies to improve your experience. Learn more